Under ASC 842, prepaid rent is now included in the ROU asset instead of being accounted for in a separate Balance Sheet account. If the lessee’s organization decides to make a payment before it’s due, there may continue to be an outstanding balance in the clearing account until the lease accounting entries catch up. Oftentimes, this entry should not be adjusted in lease accounting software and will clear itself up in the following month.

How to Calculate Average Total Assets? (Definition, Formula, Calculation, Example)

- Under ASC 842, you would see the same entries, but the prepaid rent would be recorded to the ROU asset in place of a separate prepaid rent account.

- The lease commences on January 1, 2022, and ends on December 31, 2031.

- Example – On 1st January ABC Co. paid office rent amounting to 10,000 (5,000 x 2) for the month of January & February.

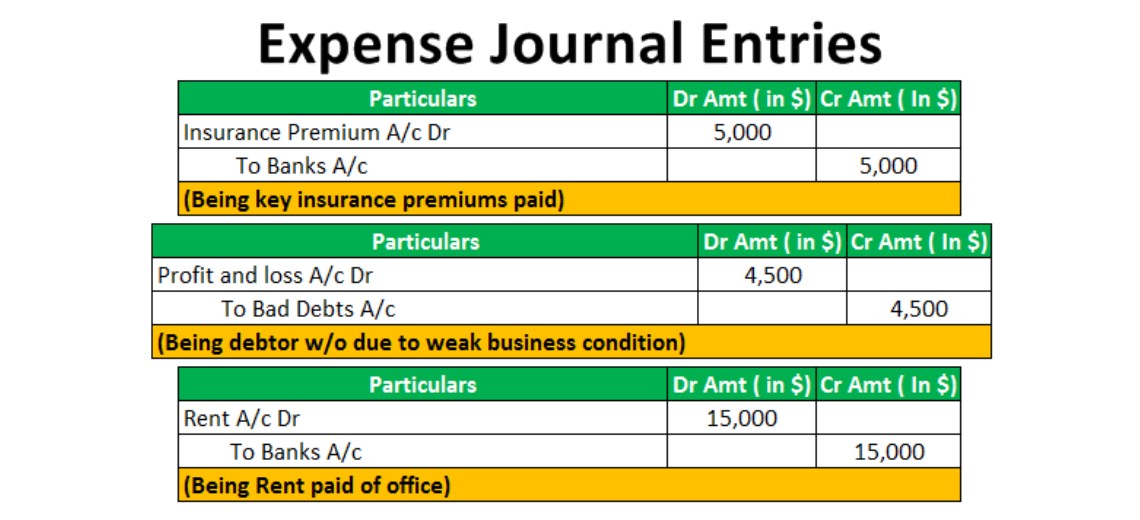

- Business expenses are costs that directly relate to revenue production, including sales, payments, insurance, and taxes.

- In practice, lease payments are not typically disbursed at a constant amount, even if they are recognized in that manner.

- A typical scenario with prepaid rent is mailing the rent check early so the landlord receives it by the due date.

XYZ & Co. will record the full amount as an expense at the beginning of the rental period. Accounts Payable account type for those VENDORS or SUPPLIERS who provide us business operational materials or services. The tenant would prepare an amortization table under ASC 842 to assist with the calculation of the periodic entries moving forward.

Rent Accounting for ASC 842: Prepaid Rent, Journal Entries, and More

Such a cost is treated as an indirect expense and recorded in the books with a journal entry for rent paid. Deferred rent is a liability account representing the difference between the cash paid for rent expense in a given period and the straight-line rent expense recognized for operating leases under ASC 840. When a rent agreement offers a period of free rent, payments are not due to the lessor or landlord. However, you are recording the straight-line rent expense calculated by dividing the total amount of required rent payments by the number of periods in the lease term. Additionally, deferred rent is also recorded for lease agreements with escalating or de-escalating payment schedules. Lease payments decrease the lease liability and accrued interest of the lease liability.

What is Deferred Rent, and When is it Recognized as a Liability?

Similarly to ASC 840, this straight-line lease expense is calculated as the sum of all of the rent payments over the lease term and divided by the total number of periods. A full example with journal entries of accounting for an operating lease under ASC 842 can be found here. Under ASC 842, those balances are no longer on the balance sheet but are reflected as adjustments to the ROU asset balance. When rent is paid in advance of its due date, prepaid rent is recorded at the time of payment as a credit to cash/accounts payable and a debit to prepaid rent. When the future rent period occurs, the prepaid is relieved to rent expense with a credit to prepaid rent and a debit to rent expense.

Journal entry to record rent payable liability

Record the necessary journal entry for the month ending April 2023. Before the case can be started, the landlord or someone working for the landlord, must demand the overdue rent from the tenant and warn the tenant that if the rent is not paid, the tenant can be evicted. The demand must be in writing and must be delivered to the tenant at least 14 days before the court case is started. The date of the invoice (your bill) has nothing to do with your accounting. The aggregate payments required under the lease total is $15,767,592.

Step 3: Calculate the operating lease liability

However, not reporting the obligation on the balance sheet may make the organization’s overall commitments appear drastically lower, depending on the significance of that entity’s operating lease portfolio. Business expenses are costs that directly relate to revenue production, including sales, payments, insurance, and taxes. Learn about the different categories of business expenses, including cost of sales, rent/mortgage payments, utilities and compensation, and insurance and taxes. Thus, the advance rent GL will be on the debit side with corresponding credit to the bank GL. On December 31, 2020, Hannifin must report in its balance sheet the rent payable of $2,500 as current liability.

This was beneficial to lessees in that the obligation for those payments did not drive up the liability balance. However, ASC 842 aims to increase transparency for stakeholders by including a lease liability and corresponding ROU asset on the balance sheet for operating leases. As the asset (prepaid asset) is being utilized it will be credited. As now the expense has been incurred, the rent expense account will be debited in order to net off the effect.

On the 1 of January they pay an advance of $6,000 to cover the first three months of the year. When a business does not own a premise to conduct its day-to-day operations, it may hire a property and make periodic payments against it. Record the necessary journal entry for the month ending March 2023.

How do you calculate the lease liability, ROU asset, and straight-line rent expense for the scenario above? In order to arrive at the correct answer under US GAAP, we need to sum the total net lease payments and then divide those free cash flow fcf formula and calculation payments by the total number of periods in the lease term. The total liability balance (short-term and long-term liability balances) is often used by stakeholders to evaluate whether to invest or lend to an organization.

Rent paid journal entry is passed in order to record the necessary rent payments against rented assets. For example, an organization’s building rent is due by the first of the month. For the check to reach the landlord and post by the first, the organization writes the check the week before on the 25th. When the check is written on the 25th, the period for which it is paying has not occurred. Therefore the check is recorded to a prepaid rent account for the timeframe of the 25th through the end of the month.