By the time, you are finished with the article, you will be able to understand clearly how to calculate these variances. I will try to be concise, so I assume you are already aware of terms like Sales, margin, profits and variance etc. If you are not fully aware, click on Commonly used financial terms every new Financial Analyst and Accountant should know! Also, start following our blog and YouTube channel LearnAccountingFinance, so that you can stay up to date with practical information and training (knowledge you can use immediately at your work). However, if the variances that occurred are huge this can be due to poor planning of budgeted data and unrealistic study about the market of the product and the competitors.

(2018 Mix % – 2017 Mix %) x Total units sold in 2018 x 2017 Profit Margin

Often, companies sell their product at a particular price, known as the budgeted or targeted price. This price is decided based on the cost of selling the product, the competitor’s selling price, the customer’s expectations, etc. The sales price variance is useful in demonstrating which products are contributing the most to total sales revenue and whether the pricing of certain products is effective. The sales variance formula shows that the variance is positive and therefore a favorable variance. The actual sales (74,250) are greater than the budgeted sales (73,000) by 2,250. If actual sales are greater than budgeted sales the formula gives a positive result and therefore the sales variance is referred to as a favorable sales variance.

What is Variance Analysis? Definition, Explanation, 4 Types of Variances

Different from sales price variance, price variance is the true unit cost of a purchased item, minus its standard cost, multiplied by the number of actual units purchased. It’s used in budget preparation and to determine whether certain costs and inventory levels need to be adjusted. Price variance concerns the difference between standard profit and actual profit. This type of variance is the same as price variance in the turnover technique. Sales variance is the overarching term that explains the difference between actual and budgeted sales. Sales variance allows companies to understand how their sales are performing against market conditions.

Do you already work with a financial advisor?

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. Let’s say a clothing store has 50 shirts that it expects to sell for $20 each, which would bring in $1,000.

- The sales price variance results from the actual price of a sales unit being different from the budgeted (or standard) price.

- It helps them plan whether to provide discounts or to raise the prices of the product.

- An unfavorable variance occurs due to a decrease in demand, an increase in competitors, a lower price ceiling, etc.

- On the other hand, a negative sales price variance is adverse/unfavorable.

- The actual price can vary due to marketconditions and changes in the competition, changes in the profit margin oroffering customer unplanned discounts.

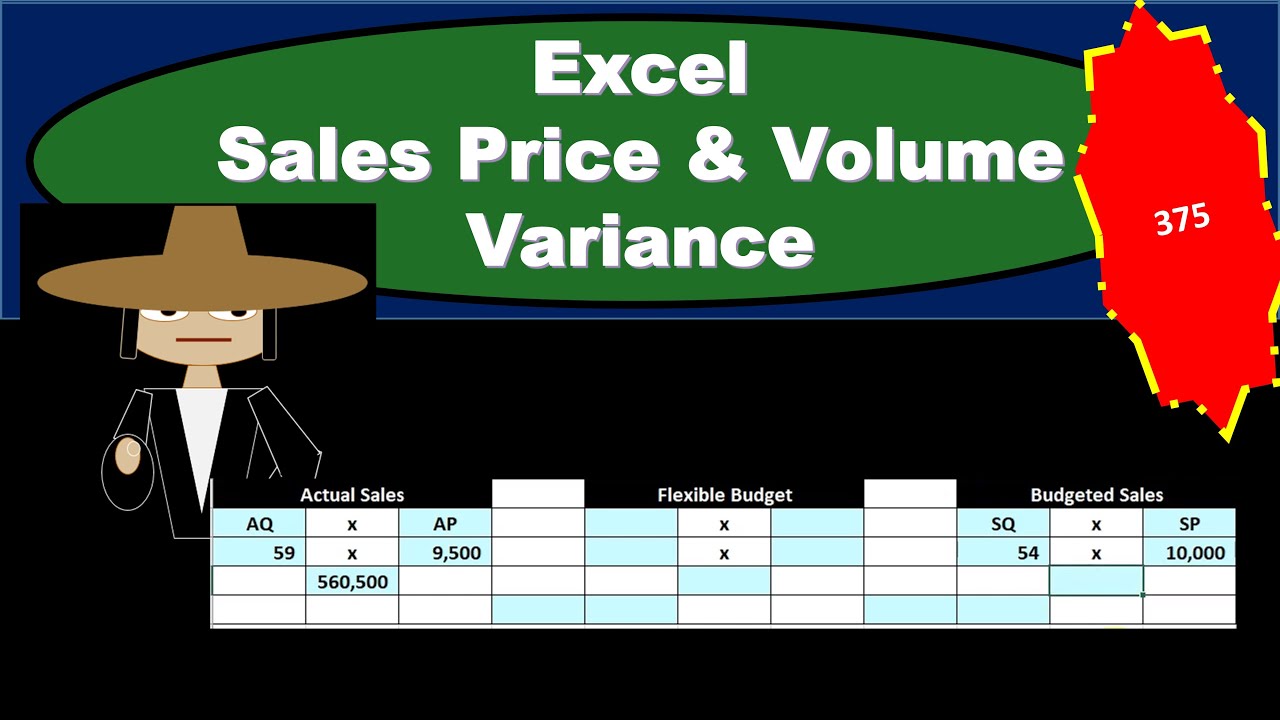

How to explain the impact of Sales Variances on Profitability or Profit Margin of a business? In this article, I am going to explain with the help of an example, how to calculate sales variances, and how to understand the impact of these variances on the profitability of your business. Note that we are calculating the impact of Sales Variances on Profit. As can be seen the sales value variance is equal to the sum of the sales volume variance and the sales price variance. The sales variance sometimes referred to as the sales value variance or revenue variance is the difference between the actual sales and the budgeted sales of the business.

Table of Contents

A sales variance refers to the difference between actual and standard sales. It tells us if the company has been able to achieve its targets or not. If actual sales are higher than standard sales, it implies that the company has done better than expected. On the other hand, a low sales variance would indicate poor performance as the company has not been able to achieve the expected sales figures.

This company realized a negative variance because their competitors gained market share just as they were differentiating their product. At this point, we have understood the impact of Sale price and volume on the $268 change in Profit Margin in 2018 vs 2017. In this situation, the company raised the price of their product to temporarily reduce demand, and they still brought in more revenue than they originally planned. The reasons can be a decline in the demand of the certain mugs and the producers are trying to clear their stock of mugs by offering the consumers discounts on the prices or there are new entrants in the market of the mugs. In conclusion, they have earned more than the expected, standardrevenue which they decided before selling the items.

Favorable sales variance happens when a company is able to sell their product at a higher price than what was budgeted. This is more likely in less competitive markets where companies are able to charge a premium for their goods stimulus payments and services. It keeps changing with any changes in selling price that the company might resort to in a particular period. The selling price variance analysis also considers how often the company has changed the price levels.

This scenario is more common in competitive markets where companies lower their prices in an effort to appeal to customers. A favorable sales price variance may result from a product having been initially underpriced, suddenly surging in popularity, or being unavailable from a sufficient number of competitors. The store ends up selling all 50 shirts at the $15 price, bringing in a gross sales total of $750. The store’s sales price variance is the $1,000 standard or expected sales revenue minus $750 actual revenue received, for a difference of $250. Remember we are trying to explain the impact of Sales variances on profit margin, not total Sales $.

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Finance Strategists has an advertising relationship with some of the companies included on this website.

Sales variance is the difference between actual sales and budgeted sales.[1] It is used to measure the performance of a sales function, and/or analyze business results to better understand market conditions. Sales price variance equals the difference between actual sales at the market price and actual sales at the budgeted price. It is unlikely that a business will have sales results that exactly match budgeted sales, so either favorable or unfavorable variances will appear in another column. These variances are important to keep track of because they provide information for the business owner or manager on where the business is successful and where it is not. Sales price variance is a helpful set of calculation for businesses to be aware of their products success in the market and how much they contribute in the overall sales revenue.